Additional Insured Endorsements: How to protect your business when you refer clients to outside inspectors or contractors

Last Updated September 21, 2023

Try as you may, you can’t always be a one-stop shop. Maybe your inspection business is still small, so you don’t offer many additional services beyond the basic inspection. Or maybe your client needs something that goes beyond the Standard of Practice (SOP).1 Regardless, if you’re unable to meet a client’s needs in-house, you’re likely to refer them to someone else.

Try as you may, you can’t always be a one-stop shop. Maybe your inspection business is still small, so you don’t offer many additional services beyond the basic inspection. Or maybe your client needs something that goes beyond the Standard of Practice (SOP).1 Regardless, if you’re unable to meet a client’s needs in-house, you’re likely to refer them to someone else.

But did you know that referring clients to other businesses incorrectly could put you at unnecessary risk?

Learn how additional insured endorsements can protect your inspection business from claims against the companies to whom you’re referring business.

What’s an additional insured endorsement?

When you refer business to another company, you expect them to perform quality services for your clients. But what if the business who received your referral made a mistake or performed poorly? If the client went so far as to file a claim against them, what’s stopping them from blaming you, too, for making a bad recommendation?

That’s where an additional insured endorsement comes in.

Whenever there’s an additional insured endorsement, there are two parties at play: the additional insured and the named insured.

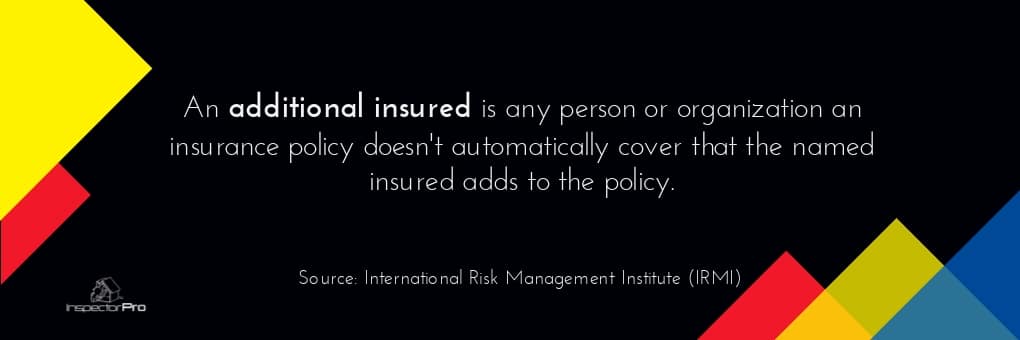

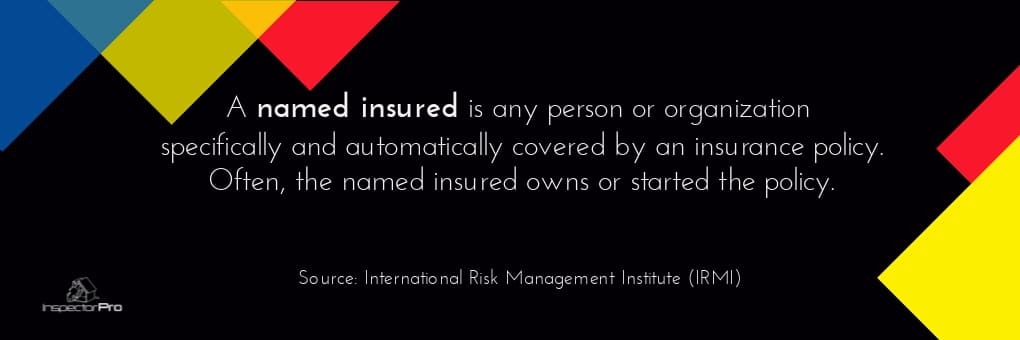

The risk management and insurance gurus at the International Risk Management Institute (IRMI) define the two parties as follows:

In this case, you would be the additional insured while the company to whom you referred business would be the named insured.

Before you recommended a client seek out additional services from another business, you’d ask that business to add you as an additional insured. By adding you as an additional insured on their insurance policy, you make sure that, if a claim does arise against them and you’re named, too, their insurance is required to provide you and your business coverage as well.

Note that the terms of the policy, including insurance limits, specifies what coverage you can receive. So be sure you understand their insurance policy’s limits.

Why are these endorsements important?

But why would you use their insurance coverage—particularly if you have an insurance policy of your own?

There are a number of reasons, but these are the main three:

1. Your policy doesn’t cover their services.

If you’re delegating additional services, chances are your insurance policy doesn’t cover those services.

For example, you delegate mold inspections to a mold assessor. Because you don’t perform mold inspections, you don’t carry a mold endorsement. No endorsement means no coverage.

2. Your policy doesn’t cover them.

Even if your policy covered their services, your policy doesn’t cover them. Since you’re the named insured, your policy only covers you and your business. In order to cover their business and its staff, you’d need to add them to your policy as an additional insured.

3. They should cover themselves.

So why not name them as an additional insured on your policy?

Doing so puts your insurance policy in charge of covering their mistakes and negligence. Even though you and your business aren’t performing their additional services, you become responsible for handling their claims. Carrying the weight of their liability could lead you to exhaust your insurance limits settling their claims. That would leave no insurance dollars left to handle your own.

That’s why additional insured endorsements are so important: They protect the referring or delegating party. They keep everyone responsible for their own work.

How can I become an additional insured on the insurance policy of the business I work with?

How can I become an additional insured on the insurance policy of the business I work with?

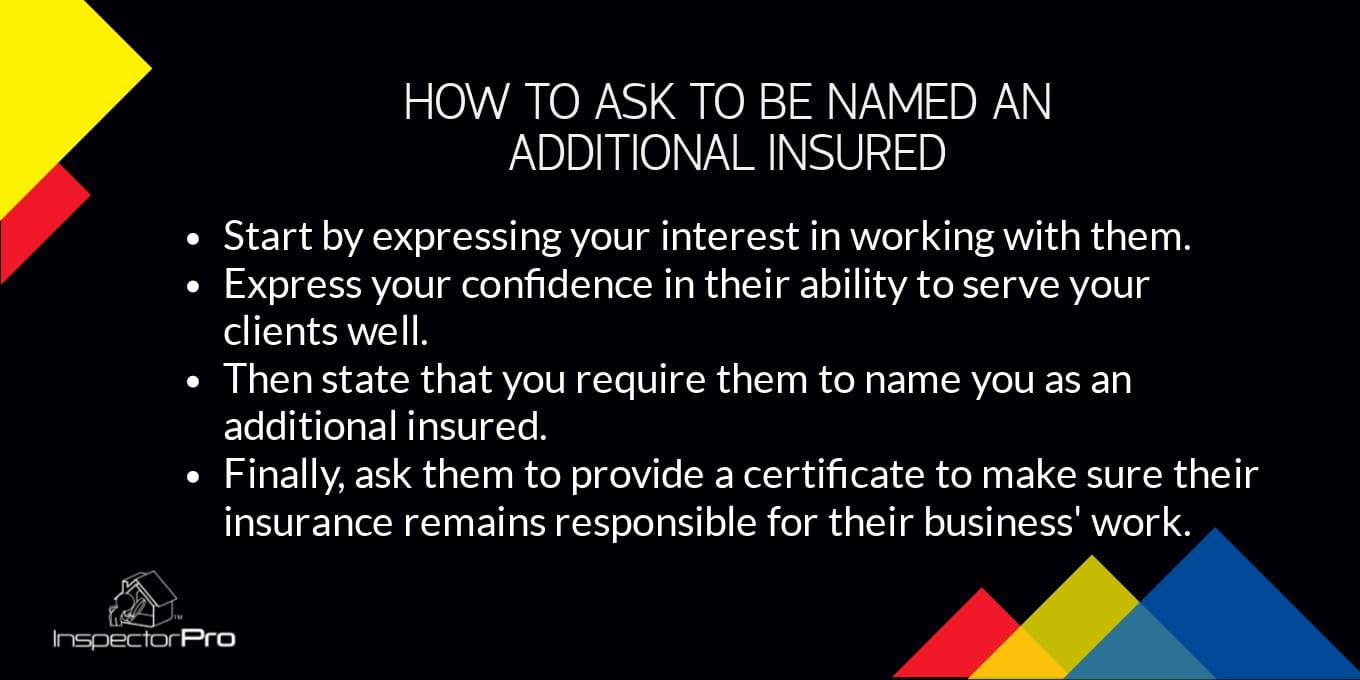

Requests to add additional insureds to liability coverage are very common and an important aspect of doing business. Thus, many of the companies you work with may already have experience in naming collaborating businesses as additional insureds.

Before you begin referring clients to another business for additional services, simply send that business an additional insured request. In your request, you may want to include the following details:

What if other businesses don’t want to name me an additional insured on their policies?

Some inspectors worry that other businesses will have reservations about naming them as an additional insured. For Michael Patton of AA Home Inspection, LLC in Kentucky, the ask works best when the business truly understands how the endorsement works.

“With the larger companies, they understand it. But if you’re talking to one-man shops, you’ll get push-back on it because they think you’re trying to write off their insurance,” Patton explained. “But, in reality, you’re just saying, ‘No, you have to have insurance to cover your business and your liabilities.'”

William Chandler of Property 360 in Florida agrees that education plays an important role in asking to be named an additional insured. While Chandler personally has not had any business deny them, Chandler believes that referring a business that would not provide an endorsement isn’t worth the risk.

“People have contractors that aren’t insured all the time. But we don’t want to refer them,” Chandler said. “I’m happy to refer good companies, but I have to tell them: In case your employee does something that you wouldn’t like, I wouldn’t want it coming back on us.”

In order to confirm that your partner named you an additional insured on their policy, obtain an additional insured certificate. Additional insured certificates are not coverage in and of themselves; rather, they prove that the coverage exits. Obtaining a certificate annually will help you to make sure that the businesses you work with continue to name you as an additional insured upon policy renewal.

If you’ve been referring other businesses work without an additional insured endorsement, it isn’t too late to start. Contact them today to make sure that your protected from potential claims that arise against them and, subsequently, you.

What should I consider when adding someone to my own insurance policy?

While this article focuses on other businesses naming you an additional insured, we’d be missing an integral piece of the puzzle if we didn’t take a moment to address naming others additional insureds on your own insurance policy.

If you’re a franchise owner or do a lot of work for home builders, the corporate franchise or the builders may require you to add them to your policy as an additional insured to protect them in case your inspection results in a claim.

Before adding anyone to your policy, just be sure you consider how the endorsement might increase your risk.

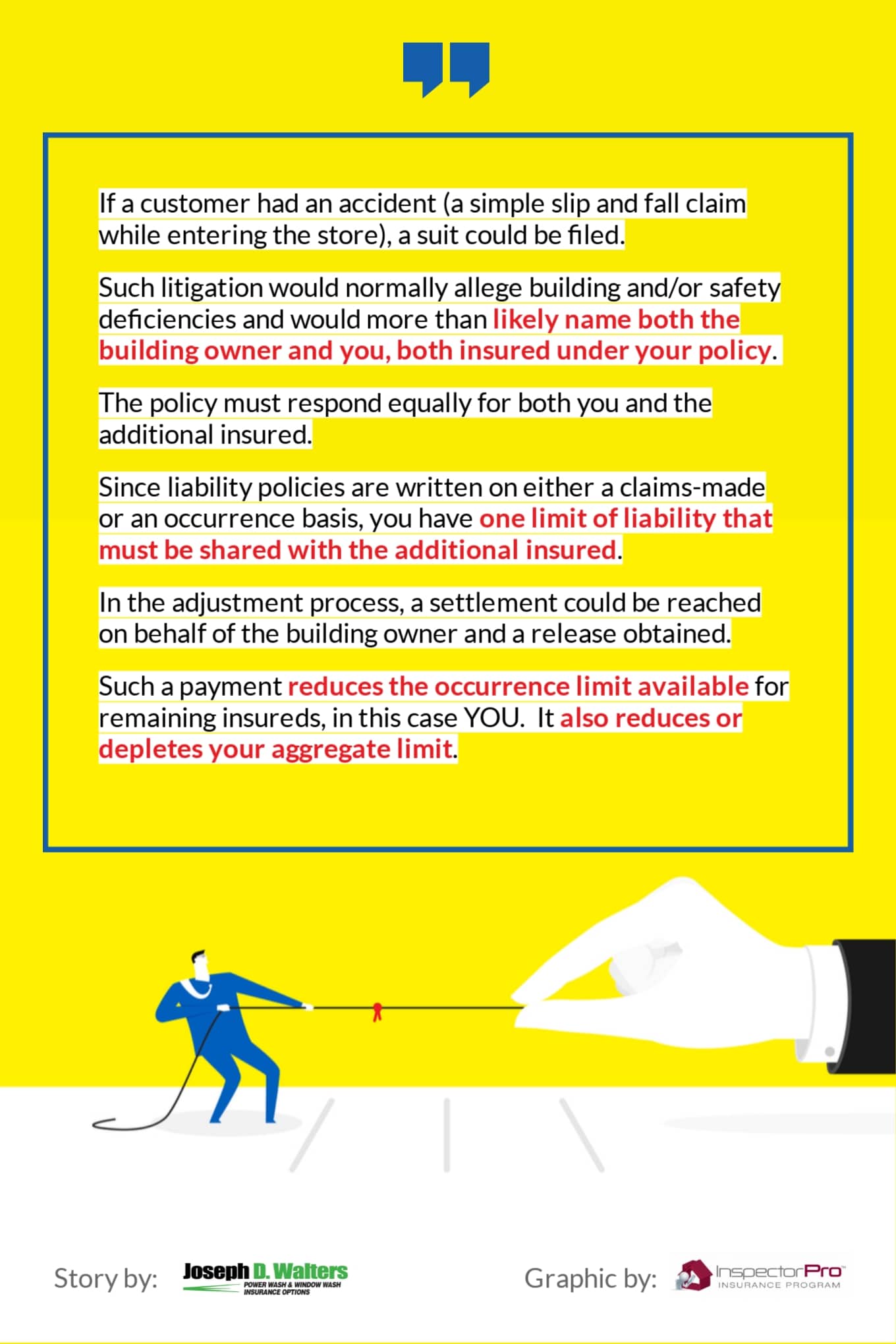

Consider this example from Joseph D. Walters Insurance, which provides coverage for pressure washers and window cleaners:

Remember, naming a company or individual as an additional insured on your policy gives them access to your insurance coverage. Thus, it’s important to restrict endorsements to those you trust.

If you’d like to add an additional insured endorsement to your policy, contact us and we’ll add the endorsement and provide endorsements and certificates for free.

Not already insured with us? Apply now for a no-obligation quote and we’ll answer any questions you may have about coverage, including additional insured endorsements.