Choosing the right entity type for your home inspection business

Last Updated November 9, 2023

Whether you’re just now entering the home inspection industry or have been an inspector for years, establishing and maintaining your own business is no small feat. One of the most common questions we receive from new or growing inspection companies is what type of business entity they should create. In this article, we hope to help you decide which entity type is right for your inspection company by sharing insights from attorneys, accountants, and your fellow home inspectors.

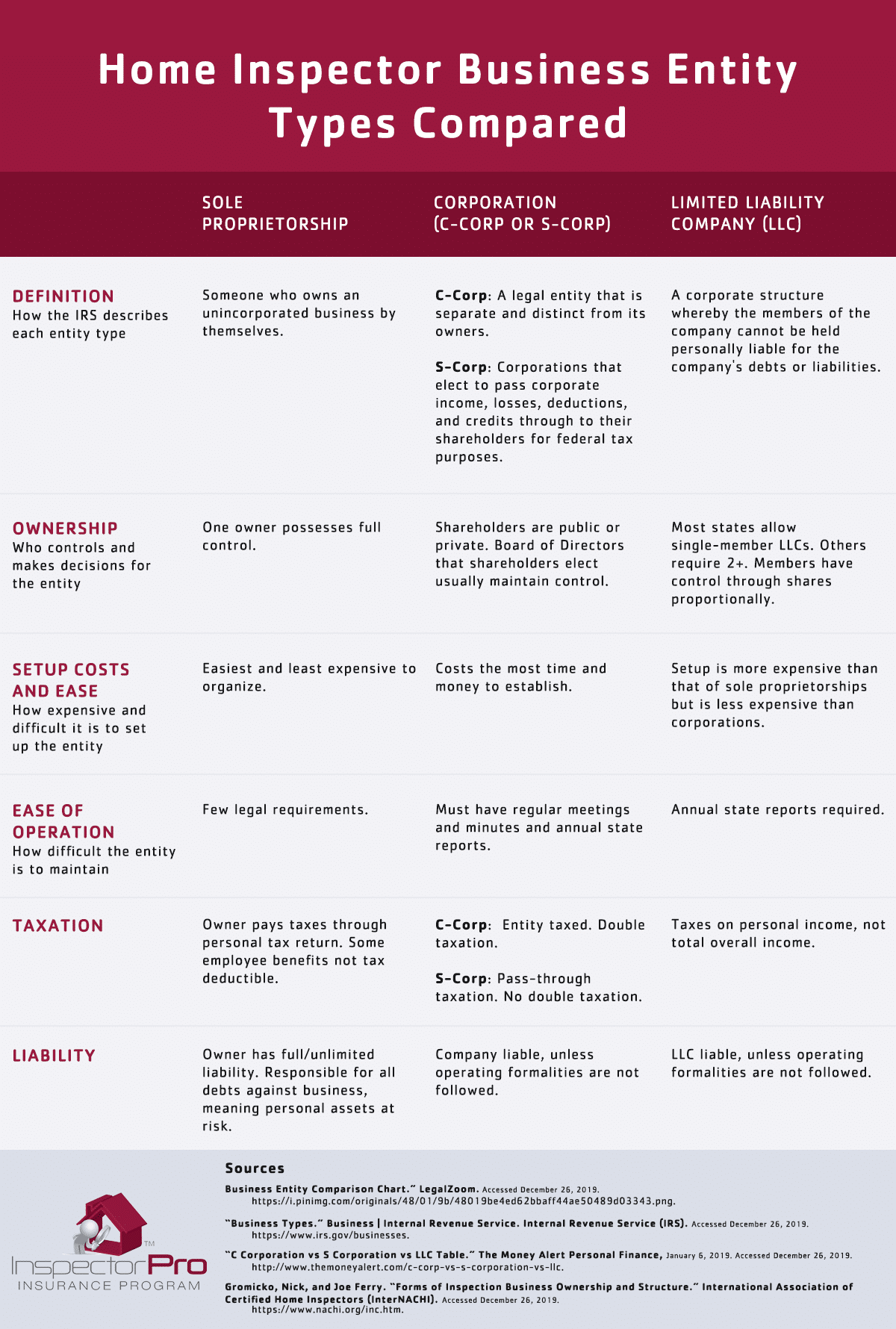

Home Inspection Entity Types: A Quick Comparison

There are three major types of business entities that home inspectors may consider: sole proprietorships, corporations (C-Corps or S-Corps), and limited liability companies (LLCs). We briefly summarize each type in the chart below.

Important Considerations

When choosing which entity type is right for your business, the home inspectors we interviewed recommend the following considerations:

Your Growth Plans

Which entity type you choose impacts ownership, income distribution, and taxation, and of each of these factors can impact your growth potential. Thus, knowing where you’d like your home inspection company to be in the future will likely impact which entity type you choose.

For example, James Szczesny of 4 Seasons Home Inspections in New Mexico has been a sole proprietorship, a limited liability company (LLC), and a corporation. With his certified public accountant (CPA), Szczesny’s strategy has been to adapt his business entity type as his company grows. As he’s generated more income, Szczesny has been more equipped to invest in the entity types that cost more to establish but provide larger tax breaks.

Alternatively, Nick Calero of CR Pro Home Inspections in Florida planned to start his inspection business as a one-man operation. If things went well, Calero intended to incorporate. After discussing his plans with multiple attorneys, Calero decided to begin his inspection career by creating an LLC.

“It all came down to what our future goals were going to be, how large we wanted to make the company, and…the steps that it would take to get there,” Calero said. “We felt that, as a small, one-person show, [an LLC] would be the best option for us [starting out].”

Your Taxes

Each type of entity that can be applied to your home inspection business has different tax implications. Take it from Steven Brewer, Founder of Steven Brewer & Company, an accounting firm that represents 35 home inspection companies across 22 states, and creator of the Facebook group The Home Inspector CPA, which answers inspectors’ business, accounting, and tax questions. According to Brewer, choosing the right entity type for your business can result in significant tax savings.

“As a sole proprietor, if you have a profit, you have a second tax you pay called a self-employment tax…of about 15 percent of the profit of the business,” Brewer said. “As the business grows, there are tax advantages to the other entities that can greatly reduce the overall effect of the self-employment tax upon your business and your personal life.”

Alternatively, filing as an S-Corp can provide inspectors with tax savings and liability protection, explained Brewer. For example, one of Brewer’s clients, a home inspection company with six inspectors, was filing as a sole proprietorship. Brewer switched the company over to an S-Corp and, that same tax year, saved the company around $7,000 in taxes.

According to Brewer, both corporations and LLCs can file their taxes as S-Corps.

Steven Rinehart of Rinehart Real Estate Inspections in Texas purchased his corporation from another inspector. Having come from a sole proprietorship, Rinehart appreciates not just the savings but the separation between corporate and personal funds inherent in a corporation.

“I think it’s easier to keep [finances] separate and not put [all my expenses on my personal] taxes,” Rinehart said.

Your Degree of Personal Liability

While not every home inspector agreed on how to limit personal liability, all of them expressed concern over individual accountability to claims and lawsuits. For many, choosing a specific entity type is one way they manage their personal risk.

Jesse Newton of All Types Of Home Inspections in California decided to become an LLC after watching his father assume liability for his sole proprietorship.

“[My father’s business] was not an LLC or corporation. He got sued, and he lost a lot of his personal belongings because of that,” Newton said. “That was my biggest motivating factor: You never know what’s going to happen on the job.”

After consulting his attorney, Emerson Treffer of Pro Home Inspection Services, Inc. in South Carolina decided on a different entity type but for the same reason: less personal liability.

“We decided to use a corporation so any legal action would have a harder time piercing our shield and we would not be individually held liable for anything we’ve done,” Treffer said.

More on how much incorporating and forming LLCs mitigates risk later in the article.

Other Considerations

Important, too, may be not just your own business venture but those of your other family members. For example, after speaking with tax advisors, Jeff Gorum of Southwest Home Inspections in New Mexico opted to create an LLC for not just his inspection business but for his wife’s massage therapy business.

“Our LLC…covers both my wife’s business and mine,” Gorum said. “We’re both in professions where there’s a likelihood that somebody could be dissatisfied or have reason to file a claim against us at some point, so we wanted to have our personal assets and finances separate from those of our business entity.”

Additionally, Joe Ferry, home inspector lawyer, and Nick Gromicko, Founder of the International Association of Certified Home Inspectors (InterNACHI) suggest taking the following factors into account in their article “Forms of Inspection Business Ownership and Structure”:

- The level of control you wish to have;

- The level of structure you are willing to deal with;

- Expected profit (or loss) of the business;

- Whether or not you need to re-invest earnings into the business; and

- Your need to take cash out of the business for yourself.

Managing Risk Against Your Business Type

Many home inspectors wonder if their entity type affects their personal and professional liability. Multiple home inspection associations and professionals have stated that home inspectors should form corporations or limited liability companies, arguing that doing so protects entity owners from personal liability for entity debts. And many corporate attorneys agree with that counsel.

According to lawyer Shane Hanna of Parsons Behle & Latimer,

“Forming an entity basically creates a separate ‘person’ and, as long as you follow some minimum formalities, it’s that ‘person,’ [your business entity], that’s liable,” Hanna said.

Like a pre-inspection agreement, while incorporating can provide some legal protection, it does not shield against every claim. In fact, there’s a term for when claimants successfully take legal action against owners, shareholders, or members of a corporate structure: “piercing the corporate veil.” Just as contract limitations do not undermine the value of pre-inspection agreements, so corporate limitations do not take away from the value of incorporating. Rather, corporate limitations invite home inspectors to consider other ways in which they can manage their risk against claims.

Because incorporating isn’t a full-proof way of limiting your personal liability, we encourage you to take two additional precautions:

Make sure you’re obeying any and all operating formalities.

Having a business entity—particularly a corporation or an LLC—requires more than the setup paperwork. Each entity type has regulations that you must follow.

Treffer has seen several home inspection companies that file as corporations without keeping up with operational formalities, which increases liability.

“It’s important that people follow the rules, and do what their attorneys tell them to do, and act like a corporation—not just go out and do home inspections,” Treffer said.

In an article for his Florida-based law firm Jimerson Birr, attorney Charles B. Jimerson discussed five popular ways to pierce the corporate veil and hold individuals personally liable. We paraphrase and provide examples of each of the five reasons below.

Claimants can do so by proving that the owners:

1. Committed fraud, wrongdoing, or injustice.

i.e. The owner, a home inspector, personally made an egregious error or omission during his inspection, so the jury find the home inspector personally liable.

2. Failed to maintain separate identities for parent companies and subsidiaries.

i.e. The home inspection business is a subsidiary of a larger contracting and remediation company. However, there isn’t anything different about the financing, officers, and corporate information that differentiates the two businesses.

3. Failed to keep business and personal assets separate.

i.e. The home inspector used the company’s bank account, equipment and other assets as his own and for personal use.

4. Failed to have adequate money and/or assets to cover business operations.

i.e. The home inspector used their personal bank account to fund many business operations with the hope that they would eventually turn a profit.

5. Failed to follow corporate formalities.

i.e. The home inspector failed to maintain the proper records and practices, like stock ledgers and annual meetings, to maintain his corporate status.

Additionally, Hanna recommends that incorporated businesses do everything they can to make it clear that their owners and employees are acting on behalf of the corporation. For example, inspector John Doe should not sign pre-inspection agreements personally; he should always sign as a manager of the business.

To make sure you’re obeying operating formalities, visit your state government’s website and consult with your local attorney.

Carry errors and omissions (E&O) and general liability (GL) insurance.

Even if you inspected every home perfectly, you cannot guarantee a claims-free existence. In fact, 60 percent of the home inspectors we insure have one or more claims during their inspection careers. And, since it’s up to a judge or jury to decide whether your entity type should safeguard your personal assets, it’s important to maintain insurance coverage for additional security. By carrying E&O and GL insurance, you can protect both your business and you.

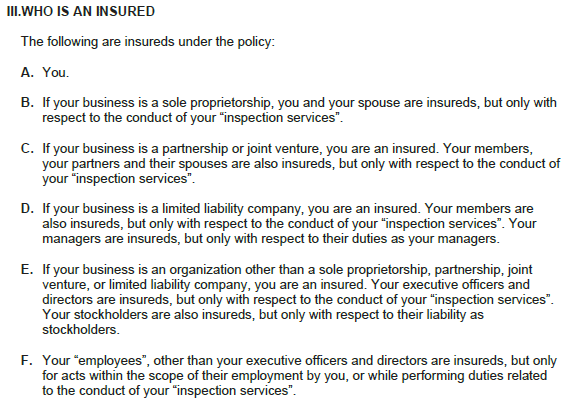

Note that which entity type you choose affects your policy’s definition of an insured. See how the section Who Is An Insured uses your entity type to describe who has coverage:

Because entity type determines who receives coverage, it’s critical to let your insurer know when you make any entity changes. We recommend promptly reporting these changes in writing to your insurance company, so they can update your records.

Final Thoughts On Entity Types

Choosing an entity type for your home inspection business can be difficult. However, with the right understanding, you, your attorney, and your accountant can make the right choice for your business.

Whatever you decide, be sure to protect your company with E&O and GL insurance. To get coverage with us, take 10 minutes to apply online for a no-obligation quote.